Gulf financial institutions are navigating through the biggest forces of change that the industry has ever experienced. Changing economic realities have already set the wheels of consolidation in motion as merger and acquisition activity across the GCC accelerates.

At the same time institutions are dealing with disruptive technologies that have completely changed how they interact with their customers. The pandemic has quickened this process, especially so across the Gulf states.

Here, the imperative of economic diversification has elevated the importance of the financial services sector in the broader narrative of macro-economic structural transformation.

AI and data science will probably bring about the most significant changes to the financial services industry that the regional industry has witnessed in its short history.

Yet, today, many financial institutions are still struggling to find their way to start the AI journey.

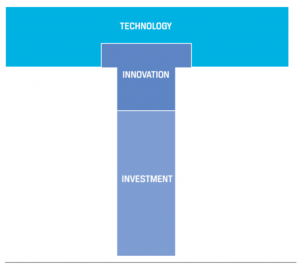

We propose a concept called T-shaped teams (See Exhibit 1) as the solution for financial institutions to overcome the hurdles in AI adoption. The idea is simple: Technology, more specifically AI and data science, is such a distinct discipline from investments that it takes an additional function, which we refer to as the innovation function, to join them and form the cohesive AI-age investment team.

Exhibit 1 The T-Shaped Team: The Investment Team structure in the Age of AI

Source: AI Pioneers in Investment Management, CFA Institute, 2019.

Exhibit 2 The Three Stages of AI Adoption

| Stage 0 | The organization has no coordinated efforts at applying AI in its core operations |

| Stage 1 | The organization has implemented at least one AI project. |

| Stage 2 | The organization has implemented more than one AI project and in multiple departments. |

| Stage 3 | AI is incorporated where appropriate throughout the organization’s operations. |

Globally, the financial services industry is eagerly looking to transform from Stage 0 in AI adoption to Stage 1 (See Exhibit 2). Not to underestimate the cost, talent, and technology hurdles in AI adoption, we believe the single most impactful factor in this transition is management vision. Senior executives have to take the lead at this stage and become champions of AI and data science — only they can ensure that an organization develops and implements a comprehensive AI strategy to introduce AI and big data into their operations.

In this process, senior executives need to build a T-shaped team, particularly its technology and innovation functions from the ground up, staff the team with proper talent, allocate enough resources to their projects and ensure support of the top executives at the organization.

Once the team is in place, the key challenge becomes connecting the investment function and technology function effectively so that the organizations can dedicate their resources to the best projects. This challenge remains constant through all three stages of AI adoption and hence the need for the innovation function to ensure that the team can collaborate effectively.

Looking through the three stages, the relative burden across the three functions shifts over time.

In Stage 1, the key is to find a project that will showcase the value and power of the AI and data science tools to the investment function. After all, technology is the new kid on the block and naturally, there will be doubts from the investment folks about the effectiveness of AI as well as some anxiety about how this might affect their career.

That puts the burden on the technology function to identify projects they have high confidence in delivering in a reasonable period of time. Ideally, it does not require too much input from the investment function but can help them do a better job. The innovation function needs to be able to evaluate whether the projects the technology function proposed fit that criteria, in particular, if the projects can deliver meaningful results to the investment function. Ideal projects are usually those that provide analytical support and individual security monitoring.

If the technology function successfully pulls off the first AI and/or big data application to the satisfaction of the investment function, then the team can expect more input from the investment function down the road. Of course, sometimes projects fail. Most “spontaneous” AI efforts at financial institutions that lack organizational backing will likely not come back from these early failures. This is where the T-shaped team will play an important role in pulling the team and organization together and continue looking for and implementing the next promising projects.

Not many financial institutions in the world are operating in Stage 2 today. To anticipate the future, for those that successfully enter Stage 2, the focus will likely be on balancing input from both the investment and technology functions. The focus is on the innovation function’s ability to leverage a small number of initial wins to gain credibility within the wider organization.

When more people from the investment function become more open in asking the technology function for support in decision-making such as security selection and portfolio construction, the team will start to deliver its full potential.

It may take a long time for some financial institutions to get to Stage 3 and we believe this will be crucial for the long-term survival of organizations. In Stage 3, the T-shaped team will finally be able to realize its full potential, with both investment and technology functions understanding each other much better, sharing their opinions openly, and communicating more frequently as needed.

We hope this scenario is an important revelation for investment managers. Technology will play a more important role in our business and hence the data science function will become a permanent part of the investment team. However, instead of being apprehensive of their presence, those who embrace them will more likely become winners in the industry in the long term.

In summary, financial institutions’ entering the AI age require commitment from their senior executives. With their continued support, T-shaped teams will enable the organization to move through the various stages of AI adoption to achieve its long-term objectives. Not all financial institutions will make it through these transitions. In fact, we believe many will fail.

It is a particularly daunting challenge for the Gulf region as major economies go through immense structural change in a comparatively short period of time.

Yet the experience of recent history demonstrates how quickly Gulf states have been able to reinvent themselves to adapt to changing realities. Countries such as the UAE and Saudi Arabia are fully future-focused.

They have shown they can quickly re-calibrate themselves to meet the needs of future generations who will not have the luxury of living in a world where perpetual hydrocarbon wealth is a given. Not only have regional governments become key strategic investors in some of the world’s cutting edge technology players, they have also invested heavily at home to help support startups in the sector. That is creating a regional talent pool that will eventually trickle down through older institutions that have yet to take their first steps and start to create the ‘T’.

The time for them to act is now.