“Bitcoin reached a new all-time high last week”, we’ve been hearing this on an almost daily basis for a few weeks, as the cryptocurrency kept moving vertically, taking an elevator to the moon. This kind of volatility in the last 7 days can’t pass unnoticed. It received worldwide attention from the financial industry and beyond. But now that a major milestone has been accomplished, What’s next for the for world’s biggest cryptocurrency?

I guess there’s no need for any introduction. Everybody has heard about Bitcoin. Maybe the whole concept of blockchain, mining and cryptography is still a bit daunting, but most people know what Bitcoin is and have at least an idea about how it works.

For the past few years, the whole perception of Bitcoin has been ever changing as the asset evolved. It started off with the reputation of being the currency for criminals and illegal online activities, and a new toy for tech enthusiasts. It then went through the bitcoin rush as it became popular and everyone took interest in it, until the bubble burst in 2017. That’s when governments and big financial institutions started taking a stance against the cryptocurrency, passing laws, legislations and regulations. It then moved to the next phase, of forgetfulness. This turned out to be the best thing that happened to Bitcoin owners and holders (those who hold Bitcoin during hard times, instead of panic selling).

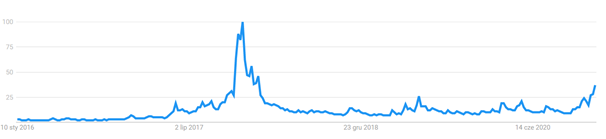

Bitcoin was extremely popular by the end of the 2017. It reached everyone, gym trainers, taxi drivers and hairdressers, everybody was talking about the new coin in town. That is usually a bad thing and is one of the main reasons why I was sceptic about Bitcoin back then. Many of my friends, were calling me on a daily basis asking for advice regarding Bitcoin. Its popularity was the main reason that I wasn’t in favor of this asset. 2018 proved that I was right and confirmed an old Wall Street saying: when everybody is telling you that a certain asset is a great opportunity, then it’s usually too late. But, is this still the case now? With a quick look on Google Trends we can see the answer is a simple no.

Google Trends. Phrase: Bitcoin

The rise that we experienced in the past few weeks was still a rise ‘in the shadows. This very simple graph shows that we still have room for growth before we reach the state of fever and craziness. You may ask me if that’s what really counts here? If we were talking about other assets like gold, oil, stocks or currencies then the answer would be no. But Bitcoin is different, in the way it sparks interest, the way it functions and the way it attracts buyers.

If I had to predict the near future for Bitcoin I would opt for a continuation of the rise and then a very sharp and volatile correction, which could scare many of the new traders. The level, to which it will rise and from which it will fall, and the depth of the next big correction – which for me is pretty much inevitable – unfortunately remain unknown.