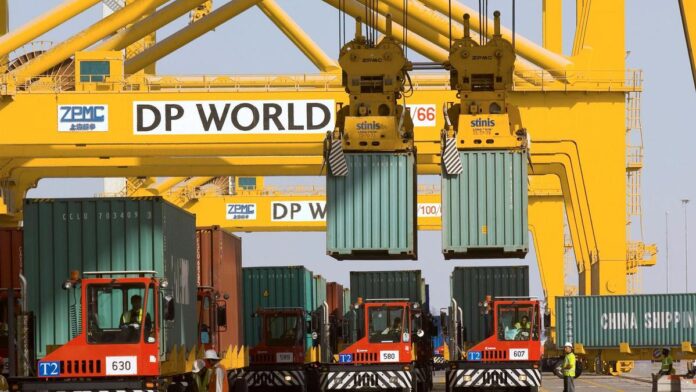

Dubai’s DP World said Wednesday that Saudi Arabia’s Hassana Investment Company (Hassana) has agreed to invest $2.4 billion in the global ports operator’s three flagship assets in the UAE as part of its strategy to capture the region’s growth potential and further strengthen its balance sheet.

The state-owned port’s operator said in a statement that Hassana will take a 10.2% stake in assets including the Jebel Ali Port, Jebel Ali Free Zone and the National Industries Park.

The deal, which is part of DP World’s quest to trim its debt comes six months after Canada’s Caisse de Depot et Placement du Quebec said it would invest $5 billion in the Middle East’s biggest port and two industrial zones.

“We believe this new partnership will enhance our assets and allow us to capture the significant growth potential of the wider region,” Sultan Ahmed bin Sulayem, DP World Group Chairman and CEO, said in a statement.

The investment by Hassana, the investment arm for Saudi Arabia’s General Organization for Social Insurance, which owns one of the world’s largest pension funds, implies a total enterprise value of about $23 billion for the three assets.

Jebel Ali Port, Jebel Ali Free Zone and the National Industries Park generated Pro-forma revenues of $1.9 billion last year and the three assets will remain fully consolidated businesses within the DP World Group after the closure of the transaction.

DP World, one of the world’s biggest port operators, has been reportedly exploring the sale of equity stakes in certain assets to reduce leverage and maintain its investment-grade rating after it agreed to acquire the Dubai operator of the free zone Dubai World for $2.6 billion in 2014.