Egypt’s pound plunged to a record low against the dollar on Thursday after the central bank unveiled plans to move to a more flexible currency regime as part of reforms that helped the government clinch a $3 billion International Monetary Fund (IMF) deal.

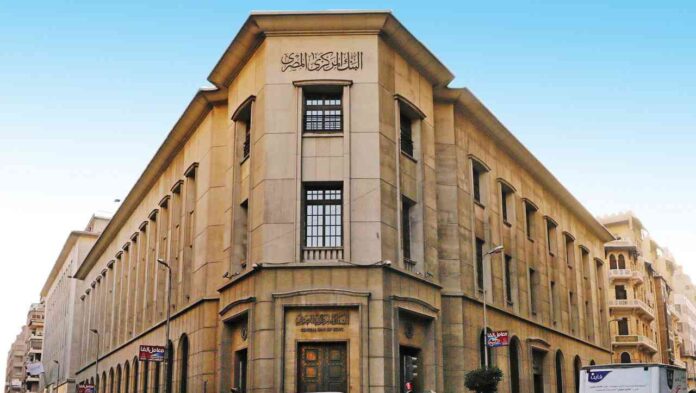

Central Bank of Egypt (CBE) said in a statement that it had raised the official borrowing costs by 200 basis points (bps) bringing the new lending rate to 14.25%, the deposit rate to 13.25% and the discount rate to 13.75%.

The central bank, which unveiled a series of economic measures, said that the exchange rate switch would now allow international markets to “determine the value of the Egyptian pound against other foreign currencies.”

The pound plunged to around 23 to the dollar from 19.67, data from Refinitiv showed. “Egypt is intent on intensifying its reform agenda to secure macroeconomic stability and achieve strong, sustainable and inclusive growth,” the CBE statement added.

Earlier this week, the Monetary Policy Committee, which was set to hold its next meeting on 3 November, followed a three-day conference in which officials discussed introducing new measures to boost the economy, such as reducing reliance on debt and foreign support by boosting exports and the private sector’s role.

Meanwhile, the IMF said that a flexible exchange rate regime should be “a cornerstone policy for rebuilding and safeguarding Egypt’s external resilience over the long term”. The IMF said a staff agreement with Egyptian officials had been reached following months of talks, as the North African nation struggles to combat surging inflation caused, in part, due to the war in Ukraine.

Egyptian officials told a news conference on Thursday that the country will receive $5 billion from international partners to help finance its external funding gap. The IMF said that a further $1 billion from a newly created sustainability fund is also on the table.